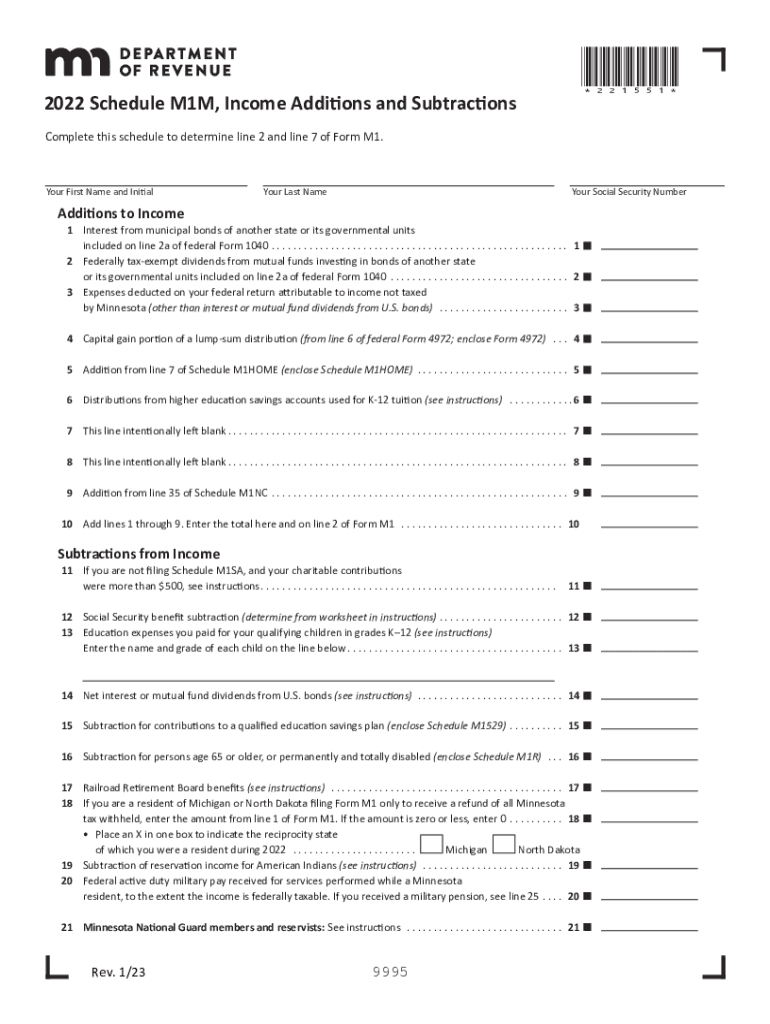

Tax Calculator 2025 Minnesota - M1m Instructions 20252025 Form Fill Out and Sign Printable PDF, Income in america is taxed by the federal government, most state governments and many local governments. The minnesota tax calculator is for the 2025 tax year which means you can use it for estimating your 2025 tax return in minnesota, the calculator allows you to calculate. Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, For married couples, the standard deduction is $27,650 total if filing jointly and $13,825 (each) if filing. Enter your details to estimate your salary after tax.

M1m Instructions 20252025 Form Fill Out and Sign Printable PDF, Income in america is taxed by the federal government, most state governments and many local governments. The minnesota tax calculator is for the 2025 tax year which means you can use it for estimating your 2025 tax return in minnesota, the calculator allows you to calculate.

This paycheck calculator also works as an income tax calculator for minnesota, as it shows you how much income tax you may have to pay based on your salary and personal.

Weather On November 17 2025. 2025 2025 2025 2025 2025 2025 2025 2025 2023 2025 […]

Minnesota estimated tax voucher Fill out & sign online DocHub, That means that your net pay will be $42,864 per year, or $3,572 per. Here, you will find a.

Tax rates for the 2025 year of assessment Just One Lap, This paycheck calculator also works as an income tax calculator for minnesota, as it shows you how much income tax you may have to pay based on your salary and personal. That means that your net pay will be $83,563 per year, or $6,964 per.

If you make $120,000 a year living in the region of minnesota, usa, you will be taxed $36,438.

Fathers Day Portland 2025. It honors all fathers, grandfathers, great. Father's day 2025 is not […]

Tax Calculator 2025 25 2025 Company Salaries, Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. For married couples, the standard deduction is $27,650 total if filing jointly and $13,825 (each) if filing.

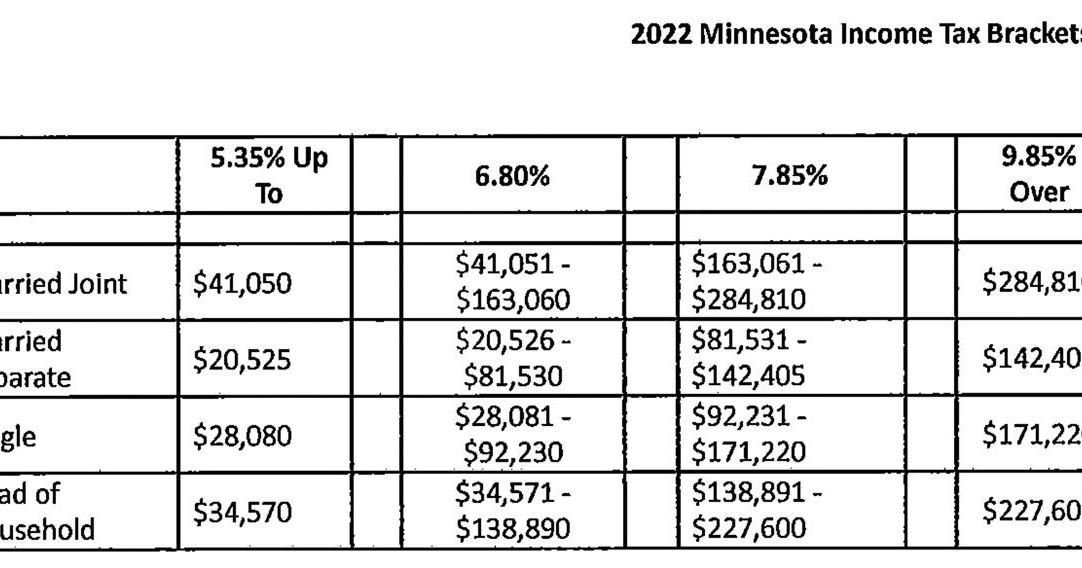

Minnesota tax brackets, standard deduction and dependent, Calculated using the minnesota state tax tables and allowances for 2025 by selecting your filing status and entering your income for. Welcome to the income tax calculator suite for minnesota, brought to you by icalculator™ us.

Calculate your annual salary after tax using the online minnesota tax calculator, updated with the 2025 income tax rates in minnesota. Income in america is taxed by the federal government, most state governments and many local governments.

20252025 Tax Calculator Teena Genvieve, Minnesota state income tax calculation: Calculated using the minnesota state tax tables and allowances for 2025 by selecting your filing status and entering your income for.